People are finding that their assets are worryingly underinsured. I have recently undertaken a number of insurance reinstatement valuations for individuals within the area and have found them all to be substantially underinsured based on valuations undertaken only a few years ago. This prompted me to contact SLCC James as I felt clients should be informed.

Having been involved in property for over 25 years, I have undertaken thousands of surveys over a wide geographical area. The vast majority of these have included an Insurance Reinstatement Cost. The post-Covid world, however, has seen a more volatile economy. Individual factors locally surrounding obtaining materials have increased building and maintenance costs, along with other contributing issues pushing up prices, such as steel being stuck in the Suez Canal!

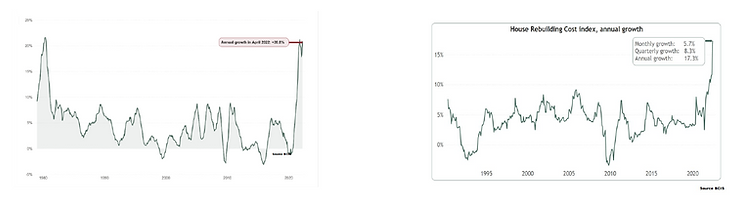

Insurance Reinstatement Costs have increased significantly as a result of these material costs, along with other economic factors. So much so that the traditional method of adding inflation to previous calculations is no longer appropriate; it has become apparent, having undertaken a number of asset insurance valuations, that there is often a significant discrepancy between the current insurance figure and the amount the property is actually insured for.

There are various risks of being underinsured, the most obvious being in the event of catastrophic loss; there will be insufficient funds to reinstate the asset. However, claims can also be significantly reduced as a result of being underinsured. For instance, if you are underinsured by 10% and claim £100,000, your claim may be reduced to £90,000, causing a funding shortfall of £10,000.

There are a number of factors that directly impact upon reinstatement cost, including age, materials used in construction, construction methodology, geographical location and size. Listed buildings or those within a conservation area are also of particular complexity as there will be restrictions as to the type of materials that can be utilised in the rebuild.

It is also vitally important (and often overlooked!) that reinstatement costs be updated if any extensions are carried out. Costs should also include substantial areas of hard standing and an allowance for boundary construction, particularly if stone or brick walls form the perimeter.

I know a number of people are looking at improving the thermal efficiency of the assets and reducing consumption of services. Installations such as rainwater harvesting, air source heat pumps and solar panels should also be incorporated into re-vised insurance valuations. Although some of these may be separately insured and warrantied by manufacturers and installers.

A qualified member of the Royal Institution of Chartered Surveyors (RICS) will be able to account for all these factors in carrying out an insurance valuation on your asset. Once the updated valuation has been obtained, this can be updated on a desktop basis annually or upon insurance renewal at; one would assume, a minimal charge.

I hope this provides you with some useful information that can protect you from incurring unnecessary costs in the future.

If Rutland Surveyors can be of any assistance, please get in touch.

Email: [email protected]

Tel: 01572 498713

Mob: 07764491512